tax on unrealized gains india

The AO added INR. Only in case of realized gains do you have to pay taxes in case of a mutual fund.

Mutual Funds Taxation Rules Capital Gains Tax Rates Chart Fy 2017 18

A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v.

. At Least 12 months. No you do not pay taxes on unrealized gains. Yellen had first proposed the tax on unrealised capital gains in February 2021.

An unrealized gain is a potential profit that exists on paper resulting from an investment that has yet to be. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset. Unrealized Gains Can you claim an unrealized loss on.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Unrealized gains are not taxed by the IRS. For example if you were ahead of the curve and bought bitcoin for 100 and.

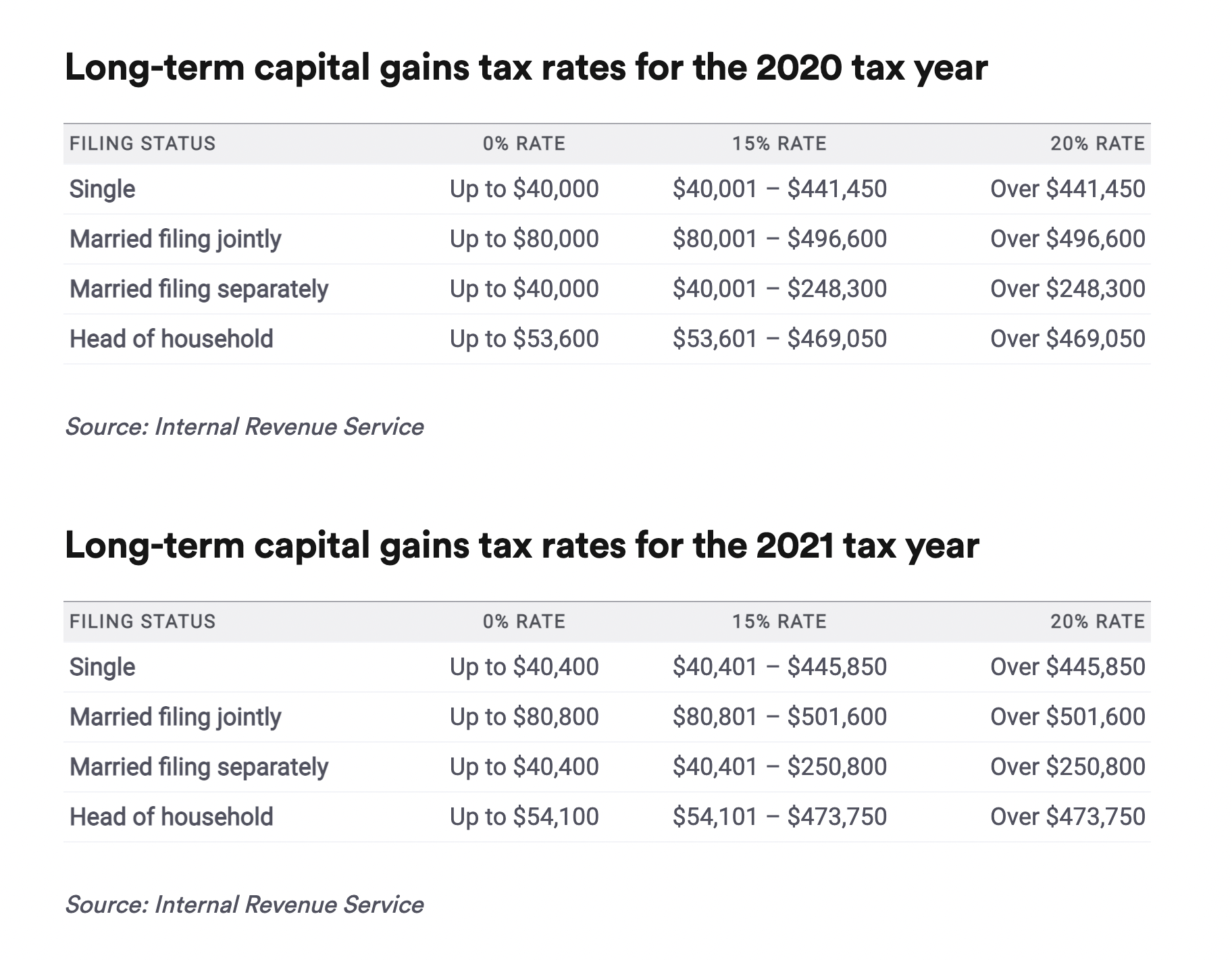

Currently the tax code stipulates that unrealized capital gains arent taxable income. At Least 12 months. The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized.

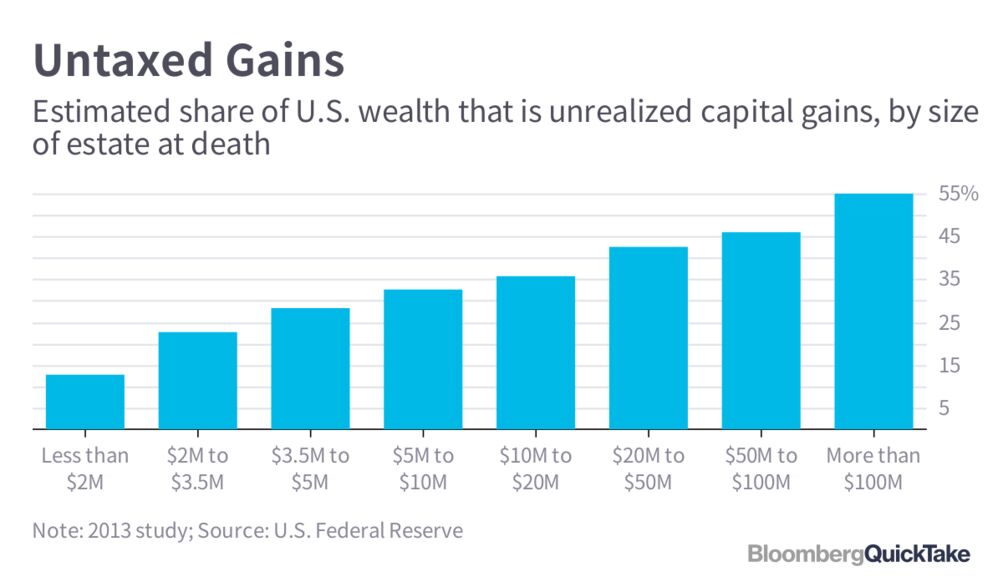

Since then many wealth managers from Howard Marks to Peter Mallouk as well as many. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million. Up to 1 lakh.

To increase their effective tax rate. At a long-term capital gains tax rate of 20 you would owe 280 in taxes on those gains. Capital gains are only taxed if they are realized which means.

This means you dont have to report them on your annual tax return. 1638 percent for a foreign. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

The taxpayer had claimed that unrealized foreign exchange gains as at the year end were notional gains and accordingly not taxable. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the. Deductions from Net Annual Value i.

Where there are unrealized gains - no tax is payable as you have not booked any profits. Unrealized foreign exchange gain. Type of capital asset.

The proposal is likely dead on arrival as it doesnt have the votes in Congress but in its present form it would levy a 20 minimum tax on all income including not just realized. Type of tax. If you decide to sell youd now have 14 in realized capital gains.

What this means is that someone who owns stock or property that increases in value. Unrealized gains only become taxable when you sell the asset and realize the gain.

Income Tax Implications For Indian Investors Investing In The Us Stock Market Mint

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

Do You Report Unrealized Capital Gains Or Losses Quora

Racial Disparities And The Income Tax System

What Are The Capital Gains Tax Rules For Different Investments In India

How Return Of Capital Can Enhance After Tax Etf Distributions Nasdaq

Unrealized Gains And Losses Explained Examples

Three Different Routes To Save Tax On Long Term Capital Gains Mint

Strategies For Investments With Big Embedded Capital Gains

Hill Democrats Shift From Raising To Cutting Taxes On The Merely Rich

Ltcg Govt Starts Work To Bring Parity To Long Term Capital Gains Tax Laws The Economic Times

Is The Estate Tax Unfair Double Taxation Or An Inequality Fix Bloomberg

Taxes From A To Z 2013 U Is For Unrealized Gains And Losses

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Crypto Tax 2021 A Complete Us Guide Coindesk

Aswath Damodaran On Twitter As Increases In Tax Rates Are Taken Off The Table Taxing Billionaires On Unrealized Capital Gains Seems To Be Gaining Traction I Am Amazed By Congress S Capacity To

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Adjustments Of Foreign Capital Gains And Losses For The Foreign Tax Credit